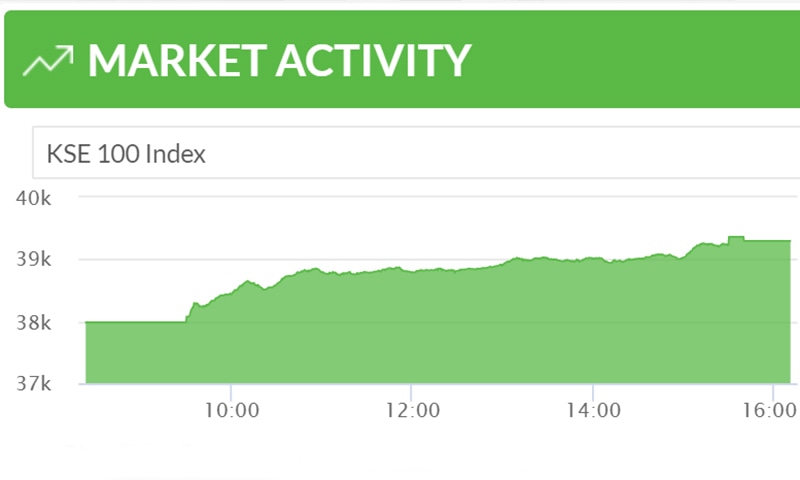

Stocks rebounded on Monday with the KSE-100 index recouping 1,312.68 points (3.34 per cent) on the first trading day of the week as Pakistan Bureau of Statistics (PBS) figures showed the inflation easing in February.

At the close of the day, the index settled in the green at 39,296.30. The lowest level the index reached during intra-day trading was 37,983.62 but as the bulls took charge, it reached an apex of 39,362.29 points.

Faizan Munshey, Head of Foreign Sales at Next Capital Limited, said easing inflation and recovery in world markets helped the index snap out of its bearish momentum.

"The stock market witnessed a recovery on Monday as inflation eased in Feb and the world markets recovered from a week-long declining trend," he told Dawn.com.

Ali Asghar Poonawala, Deputy Head of Research at AKD Securities, noted that the KSE-100 today posted its strongest intraday move upwards in 190 trading sessions since May 22, 2019.

Expectations of monetary easing were on the top of investors' mind while the soft inflation reading of 12.4 per cent year-on-year in February was the major factor driving the market, he said.

According to Poonawala, the inflation reading was "significantly below" the market consensus of 13.3pc year-on-year, possibly shifting easing expectations.

"In the medium term, all eyes are set on the IMF Executive Board deliberations (expected early April 2020), which will set the medium-term macro policy framework," the analyst said.

The PBS revealed earlier in the day that the country's Consumer Price Index (CPI) slowed to 12.4pc in February from the same month a year earlier.

Today's rally comes after the Pakistan stock market plunged 2,266 points (5.6pc) and closed at 37,984 on Friday, which put the weekly rout at a 20-month record since June 16, 2017.

The coronavirus outbreak that crossed borders into 40 countries and triggered a worldwide scare prompted investors to move from the commodities and stocks into safe havens, gold and bonds. As economists started to fret over the negative impact on global growth, the Pakistani market also gained traction with effects felt on the domestic bourse, particularly when two cases of the dreaded virus were confirmed in the country mid-week. The confidence which was pushed to new lows jettisoned shares all throughout.