The Islamabad High Court (IHC) on Thursday restored Mushtaq Ahmed Sukhera as the Federal Tax Ombudsman (FTO) with immediate effect, declaring the law ministry notification for his removal null and void.

The law ministry had removed Sukhera in June. He had been appointed in August, 2018 for a period of four years.

IHC Chief Justice Athar Minallah announced the decision, which had earlier been reserved.

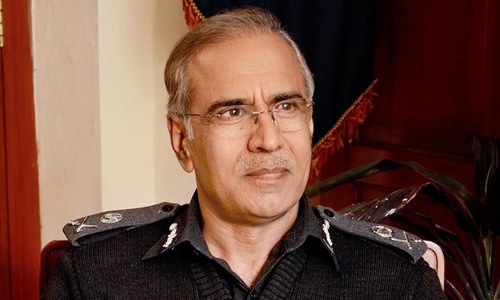

After serving 30 years in the police department, Sukhera had retired as Inspector General Police (IGP) Punjab in 2017. Later, the then chief minister, Shahbaz Sharif, had appointed him as adviser to the police department.

In 2018, he was appointed as the federal tax ombudsman. In June, he was removed from his post by the law ministry. The move, however, was challenged in the IHC. The high court, on June 14, had issued a stay against the government's decision.

Although Sukhera was removed from his post through a notification, Section 5 of the Federal Ombudsman Institutional Reforms Act, 2013, says: "An Ombudsman may be removed from office through the Supreme Judicial Council on the grounds of being incapable of properly performing duties of his office by reason of physical or mental incapacity or found to have been guilty of misconduct."

According to a media report, quoting sources, Sukhera’s involvement in Lahore’s Model Town incident, in which over a dozen people were killed, had prompted his removal from the position. Last year, an anti-terrorism court had indicted Sukhera and 115 other police officials in connection with their alleged role in the June 2014 tragedy.

However, sources were quoted as saying that it was not the Model Town case alone which led to Sukhera’s sacking; his frequent rulings against officers of the Federal Board of Revenue (FBR) had also played a part.

The Federal Tax Ombudsman Ordinance, 2002 empowered him to proceed on a “complaint by any aggrieved person, or on a reference by the president, the Senate or the National Assembly, as the case may be, or on a motion of the Supreme Court or a High Court made during the course of any proceedings before it or of his own motion, investigate any allegation of maladministration on the part of the Revenue Division or any Tax Employee”.

According to sources, some senior officials of the FBR had submitted a representation against Mr Sukhera to President Dr Arif Alvi, prompting the dismissal.