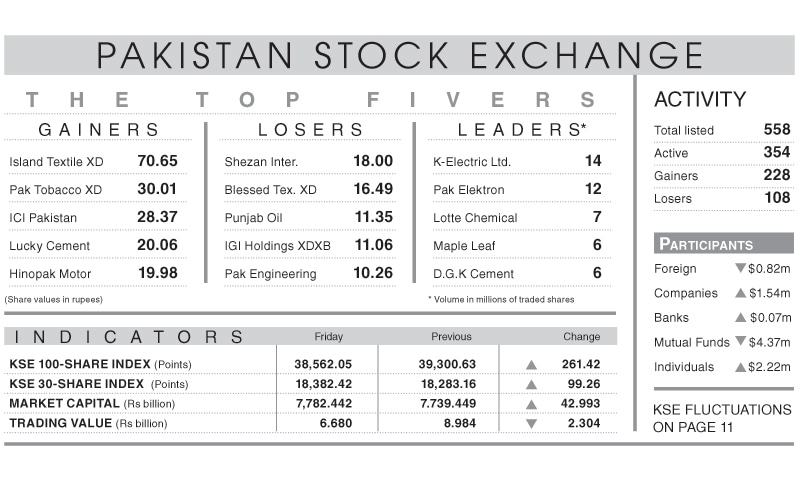

KARACHI: In a rare display of defiance against the ongoing bearish spell, the KSE-100 index recovered 261.42 points (0.68 per cent) and closed at 38,563.05 on Friday.

The index opened slightly positive as individual investors threw caution to the wind and cherrypicked stocks in an oversold market after the massive fall by 1,002 points the previous day.

But the gloom soon engulfed the market as selling erupted from institutions in the lead of mutual funds as news sank of decline in State Bank reserves by 7pc to $7.50m for the week ended Nov 30. Having shored up after the receipt of first Saudi tranche, investors worried that the depletion could leave the government scrapping the bottom of the barrel yet again.

The sentiments were dampened further by decline in international oil prices, which pulled down the index by 520 points in the first session as heavyweight exploration and production stood out as the worst performing sector.

Cement shares received boost in the second session amid news on the start of construction of Mohmand and Bhasha Dam from 1QCY19 and 2QCY19, respectively. Sector-wise, cement was the lead contributor of 118 points with Lucky, DG Khan and Pioneer Cement closing at or near their “upper circuits”. On the other hand, mixed sentiments were seen in the banking sector which added 88 points.

Major contribution to the index upside came from Lucky Cement, up 4.46pc, Engro Corporation 2.25pc, Fauji Ferililser 2.90pc, K-Electric 6.76pc and DG Khan Cement 4.96pc. On the flip side, Pakistan Petroleum, down 2.47pc, Oil and Gas Development Company 2.25pc and Pakistan Oilfields 1.89pc scrapped 117 points.

Analysts cautioned that going forward, the market could remain choppy on the back of economic concerns of increase in current account deficit, further currency devaluations and inflationary pressures that could stunt economic growth rate.

Published in Dawn, December 8th, 2018

Dear visitor, the comments section is undergoing an overhaul and will return soon.