AND so it begins. All else that has been happening thus far, from auctioning buffaloes to commuting in choppers, has been pre-game entertainment. Nothing more. The real game of running the country begins now as the new government starts to take key decisions on key matters that have profound implications for the standard of living of the people, and the profits and losses of large business interests. This is the real test, not the rhetoric and symbolic stunts that we have been treated to thus far.

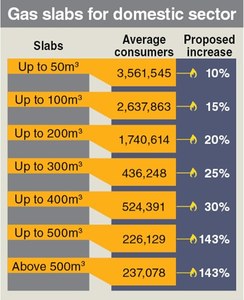

Now we will see how well this government stands up to powerful vested interests, how it explains to the people the pain they have to absorb for the sake of macroeconomic adjustment, how it decides winners and losers in the economic sphere through its tax policies or gas-pricing regimes. The finance act and the initial gas price adjustment have given us the first glimpse into this, and the picture is not pretty.

But before I get to describing the picture, it is important to make one point. There is a view that one keeps encountering these days, which is that the present government should not be subjected to critical commentary, either because it is too soon for it to prove itself, or that it stands above all criticism simply because it is the PTI led by Imran Khan. This view must be rejected outright.

Yes it is too soon for results, but it is not too soon for a direction, nor is it too soon to start calling a U-turn a U-turn. The quality of judgement we see in the leadership of the government, the direction they are setting, how well they are gelling together to articulate and follow a shared set of goals, principles, objectives, all these things are now fairly well revealed and this government is not too young, nor immune, from any critical comment on any of this.

What makes the finance act noteworthy is how it represents a backtracking on key policy measures that had upset powerful vested interests.

So those who have given this government, particularly Imran Khan, a near cult-like following, regardless of his actions, need to get used to the fact that there will be critical commentary of this government just like there was relentless criticism hurled at all previous governments, and that not everybody in the country feels they owe this devotion to the chap at the top, or that being critical of the PTI necessarily means one is sympathetic to its opponents.

As expected, the policy direction that has emerged from the new finance act is one of macroeconomic stabilisation, meaning it seeks to bridge the two massive deficits opening up in the economy, which if not addressed rapidly will create a huge economic crisis. In doing this, the PTI government is not the first, and very likely not the last, to begin its term with a large macroeconomic adjustment.

The total size of the adjustment it seeks to undertake through the finance act is 2.1 per cent of GDP, which is just over Rs700 billion going by the latest GDP figures posted on the State Bank website. This means they have to find new taxes and expenditure cuts that between them are equal to Rs700bn.

This is a smaller adjustment than what the PPP government had to undertake in 2008, which totalled 3.1pc of GDP, and even that came after it had already passed through fuel price increases and power tariff hikes. It is slightly larger than the adjustment undertaken by the Musharraf government in 2000, which was just over 1pc of GDP, though those were different times and even a 1pc adjustment back then was severe by the standards of the day. The PML-N government of 2013 undertook an adjustment comparable to what the PTI has just announced. None of them fared well through it all.

Beyond the size of the adjustment, what makes the finance act noteworthy is how it represents a backtracking on key policy measures that had upset powerful vested interests, such as the ban on purchasing cars and properties by non-filers of tax returns. The government has rightfully taken a great deal of criticism for this backtracking, so instead of repeating all that, let me add a new element here.

To justify the step, Asad Umar claimed the ban had made it difficult for overseas Pakistanis to invest and do business in Pakistan, because they are non-filers of tax returns here. This reasoning makes no sense. The people of Gilgit-Baltistan and Azad Kashmir had the same problem when the whole non-filer business began, yet solutions were found without rolling back the entire reform effort. Why can’t the same be done for overseas Pakistanis today? The climbdown smacks of a deep bow to vested interests more than anything else.

And this is not the only example. In every contact this party has had with powerful interests, it has backed down rather than hold its ground. This began with the call from Donald Trump and how it was reported by the US authorities. It continued with the adviser on commerce having to climb down from his remarks on CPEC, which was followed up by contrary remarks made by the president and the finance minister on the floor of the Assembly. So much for the review that the planning minister, Khusro Bakhtiar, was supposed to take! It was again on display with the climbdown on Prof Atif Mian’s appointment to the Economic Advisory Council, and now we are seeing the same thing happening in the framing of economic policy.

This critical weakness, this reluctance to show spine, to hold one’s own in the face of vested opposition, is the PTI’s Achilles heel. It shows this party is having a difficult time pulling itself together around a vision for reform or change. And with this weakness, it will never be able to manage the economy or safeguard the public interest.

The writer is a member of staff.

Twitter: @khurramhusain

Published in Dawn, September 20th, 2018