KARACHI: Stocks remained generally unchanged in the outgoing week with the KSE-100 index closing down by 26 points (0.06 per cent) at 42,505.

Trading remained volatile all through the week as investors analysed the current value of scrips pushing them to carefully cherry-pick. The market also showed some nervousness due to the heavy leveraged exposure (outstanding futures value was Rs16.75bn as of Sept 18) just ahead of the rollover week and slight concerns over the number of new Covid-19 cases showing a rise on the graph.

Investor sentiments were boosted by the passage of the Financial Action Task Force Bill by the joint session of parliament that provided support to the index which was on the slide on Tuesday and Wednesday. Another key highlight of the week was World Bank’s International Centre for Settlement of Investment Disputes (ICSID) decision to grant a stay order against the enforcement of penalty amounting to $6bn in the Reqo Diq case, taking some pressure off participants’ minds who were worried over the heavy potential liability.

International oil prices cast a gloomy spell on the energy shares early in the week. The key upcoming event of the SBP Monetary Policy and its date of announcement kept investors cautious although various polls undertaken by brokerage houses overwhelmingly produced a “no change” in the interest rate vote.

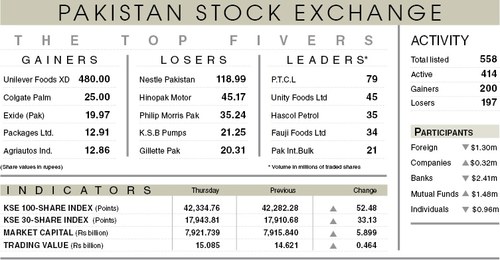

Foreigners offloaded stocks worth of $1.69 million compared to a net sell of $4.40m last week. Major selling was witnessed in commercial banks at $2.41m and food and personal care products $2.32m. On the local front, buying was reported by insurance worth $10.56m, followed by mutual funds $3.56m.

Investor participation witnessed a notable decline during the week with average volume down 28pc over the previous week to 537m shares while mean traded value also fell 35pc to $92m.

Positive news flow during the week included increase in remittances to Pakistan jumping by 31pc year-on-year to $4.9bn in July-August and surge in Foreign Direct Investments by 40pc to reach at $226.7m. Moreover, SBP’s net reserves increased by $13m to rise to the level of $12.8bn while large scale manufacturing rebounded by 5.02pc in July. On the other hand, some concerns were seen on the downward revision of country’s FY21 growth forecast to 2pc by the Asian Development Bank.

Going forward, the SBP is scheduled to announce the monetary policy for the next two months on Monday. But with consensus expectations of “no change” stance, there is little interest in the event. However, any deviation (downward revision if at all) could fuel investor enthusiasm.

The All Parties Conference to be held by the opposition against the government on Monday would also be closely watched. Like the previous week, upcoming decision and news flow over the FATF could continue to drive sentiments. And finally the nervousness associated with the rollover week would weigh over the market performance.

Published in Dawn, September 20th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.