KARACHI: Bull rampage continued for eighth session in a row, representing the longest winning streak in 2019. The benchmark KSE-100 index propelled 824.94 points (2.3 per cent) to settle at 36,803.10 on Monday.

This added Rs101 billion to the market capitalisation which crossed the Rs7 trillion-mark and settled at Rs7.06tr. Collectively in the eight sessions, the index has gained 9pc or 3,042 points — the highest since Nov 2.

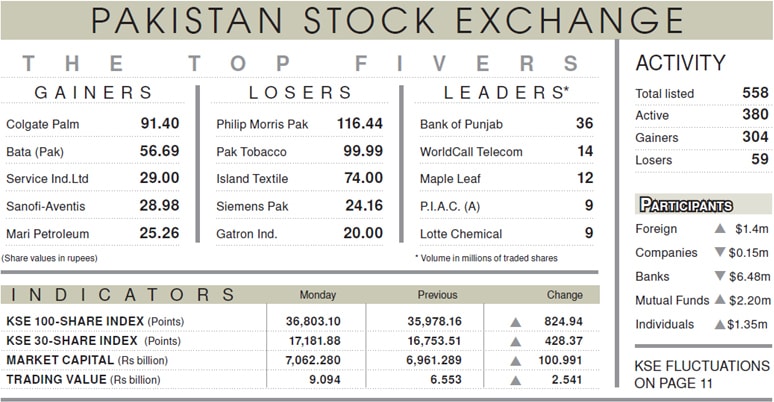

Investors went into frenzied buying across the board led by mutual funds with contributions coming in from individuals and brokers. Banks, however, tried throwing spanner in the works with heavy selling of stocks worth $6.48m.

The liquidity was successfully absorbed by local institutions. Foreigners also joined the buyers picking shares of $1.4 million. Sentiments were buoyed by several positive developments. On the economic front, MSCI review of a Pakistan downgrade did not materialise while much of the market was still confident of a rate cut in the upcoming monetary policy.

The reports last week of International Monetary Fund mission’s appreciation for over-performing on the first quarter targets, paving way for disbursement of $450m, gave confidence to investors. The downward revision of inflation target for FY20 at 11.8pc against 13.0pc also helped build sentiments.

Release of Public Sector Development Programme at Rs257bn year-to-date coming up at 133pc higher and the prime minister’s cabinet meeting, targeting development of the construction industry, gave life to cyclical stocks.

On the political side, traders thought that the dust could settle with the departure of ailing former PM Nawaz Sharif to London while most believed that the massive crowd of Azadi march in Islamabad would disperse peacefully.

Sector-wise, contribution to the index rise came from banks, increasing by 221 points, exploration and production 142 points, power 108 points, cement 82 points and oil and gas marketing companies 71 points.

The volume jumped 34pc from 210.6m shares to 282.9mn shares while traded value soared 39pc to $58.5m, from $42.1m A third of the turnover was contributed by second-tier stocks.

Major upside contribution came from Hub Power, higher by 5pc, United Bank 3.63pc, Oil and Gas Development Company 2.79pc, Habib Bank 2.21pc, Pakistan Petroleum 2.38pc, Pakistan State Oil 5pc, Lucky Cement 3.2pc, Pakistan Oilfields 2.89pc, Bank Alfalah 3.72pc and Engro Corporation 1.08pc.

Published in Dawn, November 12th, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.