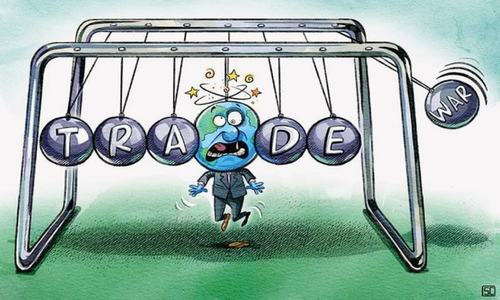

President Donald Trump is stuck up in a ‘crude quagmire’ — one of his own making.

Oil prices are surging, rallying in recent days to their highest levels in nearly four years. And the pundits are concerned. On Tuesday, Morgan Stanley raised its Brent forecast to $85 per barrel, from $77.5, citing concerns that the United States may succeed in blocking much of Iran’s 2.7 million barrels per day (bpd).

The US decision to pull out of the Iran nuclear deal and its determination to put Tehran under severe economic stress, at a time when the supply side of the global crude equation was already under strain, is contributing immensely to the market woes.

Rising gasoline prices are also a source of a political headache for Trump before November mid-term congressional elections. This is offsetting Republican claims that his tax cuts and rollbacks of federal regulations have helped boost the US economy.

Consequent to all this, President Trump has been lashing out at the Organisation of Petroleum Exporting Countries (Opec) in recent weeks, putting pressure on the producers to raise output.

Last week, after speaking to King Salman of Saudi Arabia, Trump tweeted that the Kingdom had agreed to increase its crude output by up to 2m bpd. However, in a subsequent statement, the White House had to retreat, clarifying that Riyadh has agreed to raise oil production ‘if needed’.

Once Trump went down hard on the Opec, the United Arab Emirates also underlined it “has the ability to increase oil production by several hundred thousand barrels of oil per day, should this be required to help alleviate any potential supply shortage in the market.”

All this brought to forefront the issue of global spare capacity. Over the last few years, the capacity has shrunk. Now if Riyadh, and indeed Abu Dhabi, go along with the ‘commitment’ to raise the output, the world would be left with even less spare capacity, leaving the oil markets tighter than before. And markets would react further to the development.

Adequate spare capacity is crucial to the market psyche. Markets can get jittery if it goes further down. The International Energy Agency estimates Opec’s spare capacity could fall into around 2.5m bpd (excluding Iran) – by the first half of 2019, its lowest level since the end of 2016 when record production from the Middle East reduced spare capacity to around 1.9m bpd.

Interestingly, while Trump has been twisting arms to get incremental crude output from its Gulf allies, it is also piling pressure on its European allies to stop buying Iranian oil. The two ends are conflicting to say the least.

And this has provided Iran with an interesting opportunity to play around. It is playing on the theme. On a visit to Europe last week, President Rouhani of Iran emphasised that if Iran’s crude oil exports were threatened, the rest of the Mideast’s would be as well. “It seems they do not understand what they are saying when they say Iran will not be allowed to export even a single drop of oil,” Rouhani emphasised. “All right, if you can do such a thing, do it and see the result!”

Rouhani did not elaborate further. But Iran has been asserting for long, it could shut down the Strait of Hormuz, from where a third of all oil traded by sea passes through. This could be disastrous for the oil markets and indeed Trump.

Oil will soon cost $100 per barrel due to supply disruptions caused by US President Donald Trump, Iran’s Opec Governor stressed talking to Reuters on Thursday. “The responsibility of paying unnecessary prices for oil by all consumers of the whole world, especially in US gas stations, is solely upon your (Trump’s) shoulders and the price of over $100 per barrel is yet to come,” Kazempour said.

The Iranian Revolutionary Guard commander has also warned that “there will be no guarantees for oil exports from this region unless the Islamic Republic of Iran (can) also export its oil,” hinting his forces were ready to implement the policies of the state of Iran.

Under market pressure, Washington seems to have softened its position. Instead of asking the world to halt imports completely from Tehran by November 4, Washington is now indicating it would allow reduced oil flows (from Iran) in certain cases. “We are prepared to work with countries that are reducing their imports on a case-by-case basis,” State Department official Brian Hook clarified.

This was in sharp contrast to what another senior State Department official told reporters only the week before, stressing the United States expected global imports of Iranian oil to go to zero by November 4.

The cat and mouse game is on and the jury is still out. Who wins, Goliath or Lilliputian, is still to be seen.

Published in Dawn, July 8th, 2018