Is 2018 a good year to invest in Equity Mutual Funds?

2017 was year of highs and lows for Pakistan in the stock market.

Foreign outflow on the back of Pakistan’s entry into emerging market space, and political turmoil following the dismissal of Nawaz Sharif were some of the chief determinants pulling the local bourse southwards. As a result, the market slid around 15% during the year, and the benchmark shed 23% value since its peak on May 24, spiraling to an almost 16 month low.

So would it be wise to invest in the market at this time?

According to Mohammad Shoaib, CFA, CEO of Al Meezan Investment Management Limited, the year 2018 may yield lucrative returns, making the current market correction a good point of entry.

Market overview

Pakistan’s market closed the year 2017 at a forward price per earning ratio (P/E) of around 7.5x, which is lower than the historic 10 year average. Moreover, the market’s discount to MSCI Emerging Markets Asia has widened to about 50%, as compared to the last 10 year average of 25%. As such, the market presents an appealing entry point going into 2018.

The much awaited devaluation of the Pakistani Rupee has also finally materialised, which should address structural issue of ballooning current account deficit & draw the interest of foreign investors.

Positive developments have followed the delimitation bill passed by the parliament, potentially paving way for elections to be held this year as per schedule.

A recent briefing by the Chief of Army Staff to the Senate, endorsing the supremacy of the Parliament has also eased political tension.

On the economic front, the successful issuance of a EuroBond and a Sukuk in the International market cumulatively raised US$2.5 billion. This has provided a cushion to the deteriorating current account position, indicating that Pakistan is being considered as a strong investment case by international investors. The sovereign debt issues of the country are still oversubscribed, highlighting the confidence of investors.

Ongoing development projects worth over US$60 billion under the umbrella of CPEC are well on track, and materialisation of these energy and infrastructure projects will stimulate economic activity in the country.

The market always bounces back

According to Shoaib, the election year may bring some turbulence and hiccups, but expected political stability post-elections should lead to a positive trend in the market. Historical trends also support the notion that while political turbulence may affect market valuation, the potential to bounce back has always been present.

In January 1993, when President Ghulam Ishaq Khan dismissed the Nawaz government, the market declined by 16%, but by October, the market climbed up +36%.

In November 1996, when President Farooq Ahmed Leghari dissolved the Benazir government, the market declined by 19%, but bounced back +15% by February 1997.

In May 1998 when foreign currency accounts were frozen, the market declined by 40%. In October 1999, however, the market climbed back up +21%.

Market crises in May 2005 also caused a dip of 31%, but it gained back its footing within seven months.

According to Shoaib, these trends show that the market has always managed to recover significantly after big losses due to the inherent strength of the economy and attractive valuations resulting from corrections. Several investors have capitalised on these volatile conditions.

Thinking long term: Al Meezan case

Al Meezan encourages investors to remain confident about long term investment in its Sharia Complaint Equity Funds. A small case analysis shows that investors have significantly gained over the long term so it is not advisable to exit the market every time there are hiccups.

"Take this scenario for example. If an investor invested Rs50,000 every month since the inception of Meezan Islamic Fund (MIF), he/she earned over Rs27 million in profits," Shoaib says.

"Below is how the returns would look like if you saw the graph over this period of time. You can see that there is a clear upward trend on the returns, apart from the drop right at the end (which is the current drop in the market, had you continued to invest Rs50,000 each month)."

"Past market correction such as 2008/2009 are slight drops on this graph because historically markets have always recovered after such correction periods," he pointed out. "Investors who do not panic by keeping long term returns in mind inevitably benefit from power of compounding. In addition it is very difficult to time the market for even the best of minds.”

Capital Preservation Funds: Strong returns, fewer risks

"Not all our investors are willing to invest in the equity market, because not every investor wants to enter volatile conditions, says Shoaib. "For safe investment, we recommend Al Meezan's Capital Preservation Plans, where the investors are protected against all sorts of losses."

Money that is invested in preservation products is returned with profits over and above initial investments. These funds provide investors downside protection, as well as upside potential from the equity market.

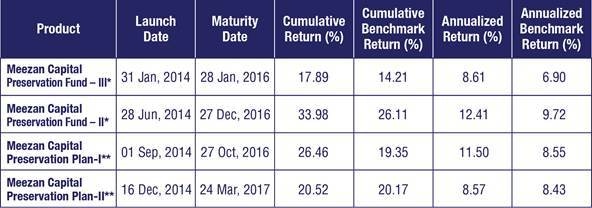

"We have launched four preservation plans in the past, and have recently launched a fifth preservation plan - Meezan Capital Preservation Plan III (MCPP-III) - after a span of three years. Investors looking to stay secure against dips in the market can invest in MCPP-III before the January 31, 2018," Shoaib concludes.

Al Meezan Investments is the largest manager for Mutual Funds in Pakistan, with an AM1 rating, the highest management quality rating (JCR-VIS) in Pakistan. With over 22 years of successful track record in managing investments, Al Meezan is the pioneer in introducing Shariah compliant investments in Pakistan, with a vision to make ‘Shariah compliant investing a first choice for investors’. Several of their investments products offer a tax rebate to investors.

All investments in mutual fund are subject to market risks. Past performance is not necessarily indicative of the future results. Please read the offering document to understand the investment policies and the risks involved.

This content is a paid advertisement by Al Meezan Investments and is not associated with or necessarily reflective of the views of Dawn.com and its editorial staff.

Dear visitor, the comments section is undergoing an overhaul and will return soon.