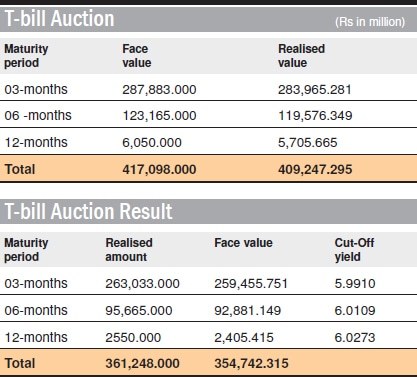

The government raised Rs354.74bn from the auction of Pakistan MTBs of various tenors held on May 11, smaller against the received bids of Rs409.24bn. It was however, higher against the auction target of Rs350bn.

Of the total raised amount, three month T-bills fetched the highest Rs259.45bn at a cut off yield of 5.99pc, followed by six month T-bill Rs92.88bn at 6.01pc and 12-month T-bill Rs2.40bn at 6.02pc.

Three month T-bill attracted the highest amount of Rs283.96bn: six month T-bill Rs119.57bn, and 12-month T-bill Rs5.70bn.

Deposits and other accounts of all scheduled banks stood at Rs11,070.49bn after a 1.28pc decrease over the preceding week’s figure of Rs11,214.04bn, according to the weekly statement of position for the week ended May 05. Compared with last year’s corresponding figure of Rs9,667.62bn, the current week’s figure was higher by 14.51pc.

Borrowings by all scheduled banks decreased in the week under review by 1.90pc. Compared to last year’s corresponding figure, the current week’s figure is higher by 29.92pc

Deposits and other accounts of all commercial banks stood at Rs10,996.66bn against preceding week’s deposits of Rs11,140.12bn, showing a decline of 1.29pc. Deposits and other accounts of specialised banks stood at Rs73.83bn, lower by 0.12pc against previous week’s figure of Rs73.92bn.

Total assets of all scheduled banks stood at Rs15,503.50bn, lower by 0.96pc over preceding week’s figure of Rs15,653.06bn. Current week’s figure is higher by15.42pc compared to last year’s corresponding figure of Rs13,431.80bn.

Total assets of all commercial banks stood at Rs15,258.36bn, lower by 0.94pc over previous week’s figure of Rs15,403.73bn, while total assets of specialised banks at Rs245.14bn, were smaller 1.68pc over the previous week’s Rs249.33bn.

Gross advances of all scheduled banks stood at Rs5,805.25bn, higher by 0.50pc over the preceding week’s figure of Rs5,776.68bn. Compared with last year’s corresponding figure of Rs4,957.68bn, current week’s figure is higher by 17.09pc.

Advances by all commercial banks increased to Rs5,636.76bn from previous week’s Rs5,608.29bn indicating a rise of 0.50pc, whereas advances of specialised banks stood at Rs168.49bn against previous week’s Rs168.39bn.

Borrowings by all scheduled banks decreased in the week under review. It fell by 1.90pc to Rs2,231.01bn against previous week’s Rs2,274.21bn. Compared to last year’s corresponding figure of Rs1,717.24bn, current week’s figure is higher by 29.92pc.

Borrowings by commercial banks in the week at Rs2,203.90bn were lower by 1.96pc against previous week’s Rs2,247.94bn. Borrowings by specialised banks stood at Rs27.10bn against the previous week’s Rs26.26bn.

Investments of all scheduled banks stood at Rs7,791.52bn against preceding week’s figure of Rs7,794.31bn, showing a decrease of 0.04pc. Compared to last year’s corresponding figure of Rs6,822.66bn, current week’s figure is higher by 14.20pc.

Investments by all commercial banks stood at Rs7,736.49bn, smaller by 0.13pc against preceding week’s figure of Rs7,746.50bn, whereas investment by all specialised banks stood at Rs55.03bn against preceding week’s figure of Rs47.81bn.

Notes in circulation stood at Rs3,795.23bn during the week ended May 05, according to the State Bank of Pakistan, against Rs3,731.47bn a week earlier, showing a rise of 1.70pc. Compared to last year’s corresponding figure of Rs3,254.29bn, current week’s figure is higher by 16.62pc.

Published in Dawn, The Business and Finance Weekly, May 22nd, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.