KARACHI: An additional sales tax imposed on Compressed Natural Gas stations may result in the closure of the CNG industry altogether, said Shabbir Sulemanjee, chairperson of the All Pakistan CNG Association’s Sindh chapter on Tuesday.

The association gave a 10-day ultimatum to the Federal Board of Revenue (FBR), Oil and Gas Regulatory Authority (OGRA) and the government to resolve this matter with mutual consent of CNG dealers or they would be compelled to close down all CNG stations across the province, resulting in the industry’s closure, revenue loss and increase in unemployment.

CNG stations in Sindh are said to have been served notices from the Sui Southern Gas Company (SSGC) for the recovery of Rs4 billion within 10 days on the levy of additional sales tax from April 2014 to date.

It was explained that the FBR had amended Section 3 (8) of the Sales Tax Act 1990 through an ordinance resulting in an impact of 34 per cent charged in gas bills in comparison to the 17pc charged earlier under Section 3 (1) of the Sales Tax Act 1990.

Highlight their problems at a press conference in the face of the additional sales tax, Mr Sulemanjee demanded that the government constitute a committee comprising tax experts, government representatives and stakeholders from the APCNGA to resolve the issue of double taxation at the earliest.

Giving some back ground, the APCNGA chairman said: “It is important to mention here that the CNG industry before 2008 came under the normal tax regime, Section 3 (1) of the Sales Tax Act 1990, for which 17pc of GST was charged as gas charges in gas bills. This is the common practice in all trades and businesses including industries and manufacturing processes.

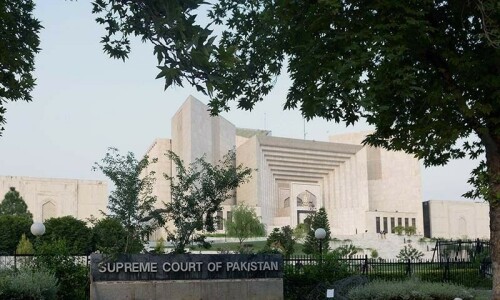

“After 2008, the FBR imposed 26pc under Section 3 (8) of the Sales Tax Act 1990, which was struck down by the Supreme Court of Pakistan on 10-12-2013, declaring it unconstitutional. So they reverted back to the normal tax regime in which 17pc was charged.

“On the directions of the Supreme Court, the gas bills were properly generated with 17pc GST being deducted on gas charges up to three months after which the government introduced the amended Section 3 (8) of the Sales Tax Act 1990 through an ordinance on March 28, 2014.

“The new ordinance changed the basic principles of the Sales Tax Act 1990 through a unique mechanism that was not based on the ground realities. CNG stakeholders also were not consulted before the execution of the said ordinance.

“In line with the new ordinance, the concept of determining the units sold from the gas bills becomes unjustified. Instead of charging 17pc on the gas charges there is a sales tax of 17pc on the total sales determined by the total kilograms consumed in the gas bills which is multiplied by the retail rate of the CNG notified by the OGRA from time to time. There is also no input in terms of sales tax on electricity bills, lubricants, diesel, spare parts and the plant and machinery is allowed adjustment against the total output. In other words, the new ordinance would compel CNG station to charge sales tax on the total sales as well as on other purchases resulting into double taxation and a clear violation of Section 7 (1) of the Sales Tax Act 1990.”

Mr Sulemanjee was of the opinion that the Ministry of Finance under IMF’s pressure was trying to increase taxes in an industry that already is a prompt tax payer. “They should rather concentrate on those who don’t file their taxes while running major businesses. The CNG industry is already facing a crisis due to distorted price breakups from OGRA. The operating costs of CNG stations has remained unchanged for more than three years, but there has been a substantial increase in the electricity tariff, cost of manpower and so many other expenditures that have been completely ignored by OGRA.

“With the price of Rs67.50 per kilogram as set by OGRA that were reduced by Rs4 per kg from Sept 1 2015, it has become extremely difficult for CNG stations to also survive the exorbitant increase in taxes from time to time.

“APCNGA, Sindh, strictly condemns the conspiracy to sabotage the CNG industry and appeals to the government to immediately constitute a committee based on tax experts and stakeholders from the APCNGA to resolve this matter with mutual consent while taking our grievances into account.

“If FBR fails to listen to the stakeholders genuine issues, then we will be forced to close all CNG stations in Sindh within 10 days, resulting in the closure of the industry, loss of revenue and loss of employment,” the APCNGA’s chairman concluded.

Published in Dawn, November 25th, 2015