WHEN the modarabas first came on the financial scene in the 1990s, the faithful put their trust and money in them to save and yet remain Shariah-compliant.

Unfortunately, the below-par performance, along with fraud, by a sizeable number of modaraba managers brought the entire sector into disrepute.

Yet in recent years, the sector has quietly managed to shake off its tarnished image and moved to the forefront of the non-banking financial institution (NBFI) segment.

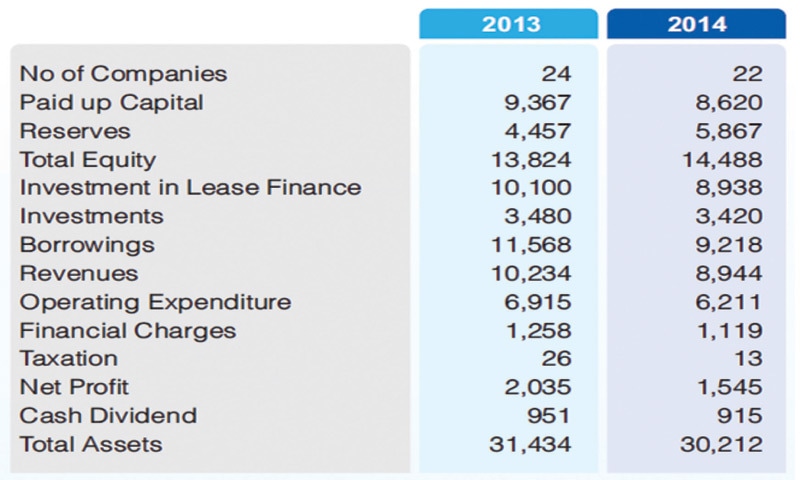

According to the NBFI and Modaraba Association of Pakistan’s 2014 yearbook, the asset base of the modaraba sector stood at Rs30.21bn by June 30, 2014 and its total equity amounted to Rs14.49bn.

During the year, the sector recorded a cumulative profit of Rs1.55bn, with major contributions from Allied Rental Modaraba (Rs651m), First Habib Modaraba (Rs285m), Standard Chartered Modaraba (Rs182m), First Treet Manufacturing Modaraba (Rs86m), First Punjab Modaraba (Rs74m) and First UDL Modaraba (Rs68m).

A total of 20 out of 25 modarabas declared profits and 17 announced cash dividends ranging from 1.5-50pc, while the results of three firms were delayed due to numerous reasons. The yearly payout to certificate-holders increased slightly from Rs1.01bn to Rs1.02bn in the earlier year.

A total of 20 out of 25 modarabas declared profits and 17 announced cash dividends in FY14

The modarabas, leasing companies and investment banks are regulated by the Securities and Exchange Commission of Pakistan. These players joined hands and have been collectively represented by the NBFI and Modaraba Association of Pakistan from July 2010 onwards. At present, its 40 members include 27 modarabas, 10 leasing companies and three investment banks.

Meanwhile, the number of listed modarabas stands at 25. A certificate of face value of Rs10 o Standard Chartered Modaraba (SCM) stood at Rs30.8 on September 18, behind Imrooze Modaraba (Rs86.77) and Allied Rental Modaraba (Rs40). However, SCM’s certificates are more briskly traded than those of its other two peers.

Modaraba scripts scarcely ever make it to the top 10 daily volume chart at the stock exchange, as foreign and institutional investors are said to be far more interested in bank stocks.

“With regard to the modaraba sector, the SECP has always encouraged it to introduce innovative Shariah-compliant products and we are focused on the development of Islamic financial services provided by the modarabas,” said SECP Chairman Zafar-ul-Haq Hijazi in a report.

Under a modaraba, an arrangement is made between two parties: one provides the capital (rabb-ul-maal), and the other party, called the mudarib, contributes through its skills. A modaraba can undertake virtually any business activity that is not in violation of Islamic law. Modarabas can be formed for specific or multiple purposes, for either a fixed or an indefinite period. Capital is raised from the public through certificates, which are similar to shares of companies.

For the year ending June 2014, the Standard Chartered Modaraba earned a net profit of Rs182m, up from Rs121m in the previous year. Its earnings-per-certificate improved to Rs4 from Rs2.67.

“This is the highest profit since the incorporation of the modaraba and has mainly been due to the efficient management of financial charges, which were reduced by more than 10pc,” the company’s chairman, Najam Siddiqi, wrote in the directors’ report for FY14.

Revenue (net of Ijarah assets depreciation) amounted to Rs690m, against Rs696m a year ago. Financial charges amounted to a big Rs386m, but were still down from Rs439m in FY13. The board announced a dividend distribution of Rs136m, against Rs91m in FY13.

At the close of FY14, SCM held certificate capital of Rs454m, with its total equity amounting to Rs1.09bn. The highest share of its investment — Rs4.19bn — was in ‘Ijarah finance and Ijarah assets,’ followed by Rs1.35bn in ‘diminishing musharika and Sukuks’.

The modaraba’s investment in Ijarah finance and assets, and in diminishing musharika (including house finance diminishing musharika) had declined by 5.91pc to Rs5.55bn.

The chairman pointed out that “to arrive at an efficient structure, total assets have reduced by 11.76pc to Rs6.04bn against Rs6.84bn last year”. He added that the business had been driven mainly by deepening relationships with selective clientele and initiating relationships with good names. “The asset portfolio has a good mix of multinationals, large- and medium-sized local corporate and selective SME relationships.”

Including Ijarah assets worth Rs4.2bn and net investment in Ijarah finance at Rs359m, SCM’s total assets stood at Rs6.04bn by June 30, 2014.

Published in Dawn, Business & Finance weekly, September 28th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play

Dear visitor, the comments section is undergoing an overhaul and will return soon.