KARACHI: Pakistani stocks rose on Monday, led by the fertiliser sector, but in thin volume, as political turmoil kept investors cautious, dealers said.

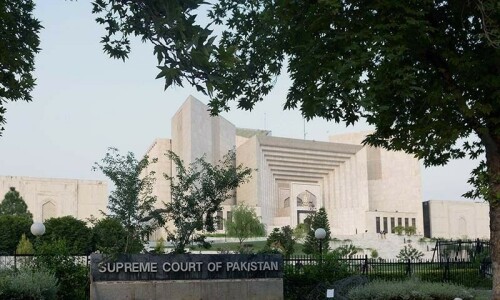

Pakistan's Supreme Court on Monday ordered Prime Minister Yusuf Raza Gilani to appear before the court for failing to pursue corruption cases against the president and other officials, a sharp escalation in the government's battle for survival.

The Karachi Stock Exchange's benchmark 100-share index ended 0.89 per cent, or 98.19 points, higher at 11,112.65 on turnover of just 26.68 million shares.

“Investors are unlikely to take any fresh positions in the market until there is clarity on the political situation,” said Shuja Rizvi, a dealer at Al-Hoqani Securities.

The court threatened the premier with contempt, the latest blow for the civilian administration, which also faces pressure from the military over a mysterious memo seeking US help to avert an alleged coup last year.

While Gilani is the one facing a contempt hearing, most observers say the court's real target is President Asif Ali Zardari.

Among the most active companies, Fauji Bin Qasim ended 1.4 per cent higher at 44.19 rupees, while Fauji Fertiliser closed 1.8 per cent higher at 165.49 rupees.

The rupee firmed on Monday amid a lack of import payments, but dealers expect pressure on the local unit to continue in the short to medium term because of a bleak economic outlook.

The rupee ended at 90.16/21 to the dollar, compared to Friday's close of 90.28/32. The rupee fell to a record low of 91.28 to the dollar in intra-day trade last week.

Analysts say concerns about the country's economic stability, especially a weakening current account, are adding to pressure on the rupee.

Pakistan's current account deficit stood at $2.104 billion in July-Nov compared with $589 million in the same period a year earlier. The deficit is likely to widen further in the coming months because of debt repayments and a lack of external aid.

In the money market, overnight rates eased to end at between 10.25 per cent and 10.75 per cent from the level of 11.25 per cent on Friday because of slightly improved liquidity conditions.

Dear visitor, the comments section is undergoing an overhaul and will return soon.